High-End Properties and Post-Wildfire Recovery Drive Local Surges

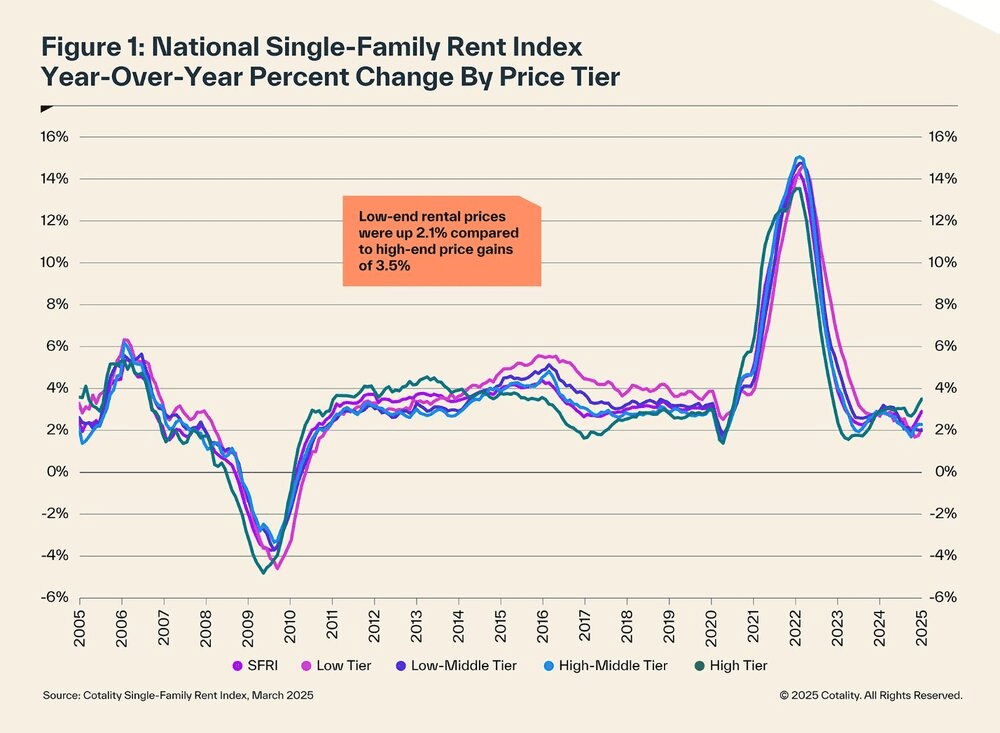

Single-family rent prices across the U.S. rose for the third consecutive month in March, according to Cotality’s latest Single-Family Rent Index (SFRI). Nationally, rents increased by 2.9% year over year, slightly up from the 2.8% gain recorded in March 2024, indicating a slow but steady recovery in the rental market.

“Single-family rent growth picked up for the third consecutive month in March, appearing to have bottomed out in December of last year,” said Molly Boesel, Senior Principal Economist at Cotality. “Markets with large numbers of new rental units coming online showed softness, as these new units give renters some bargaining power.”

🔻 Where Rents Are Flat or Falling

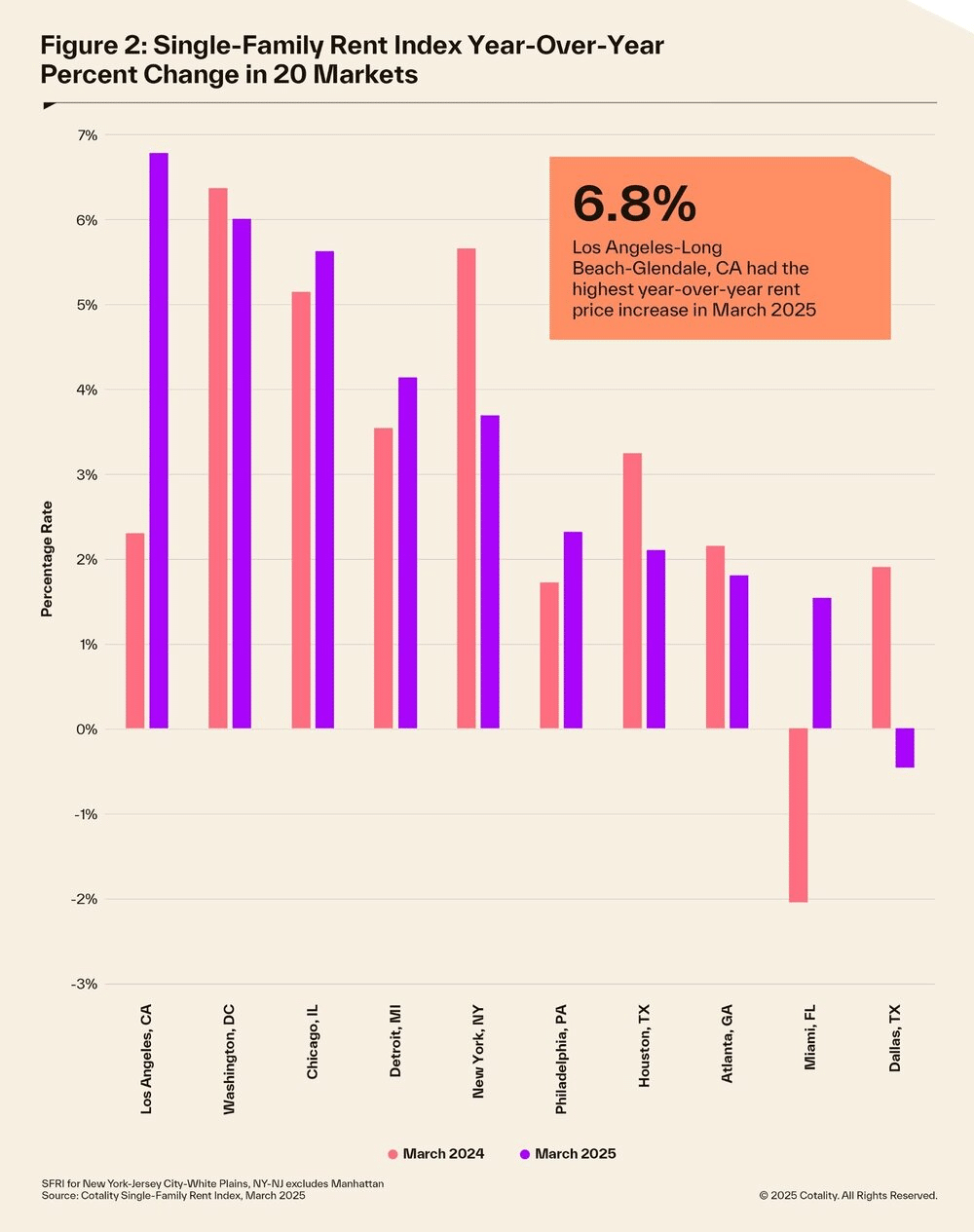

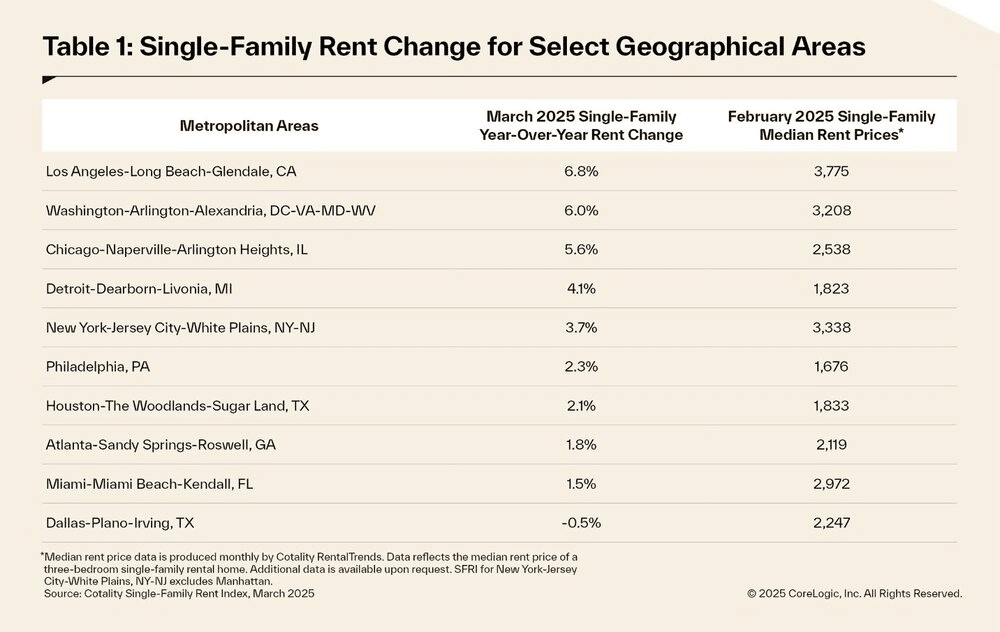

Not all markets are experiencing growth. Dallas saw a -0.5% year-over-year decline in single-family rents — the lowest among major metros. Experts attribute this to a surge in supply, with new rental units providing tenants more choices and leverage in negotiations.

💎 High-End Rentals Lead the Market

The luxury segment continues to outperform:

- High-end properties posted a 3.5% annual rent increase, up from 2.9% in March 2024

- Lower-tier rentals grew at a slower pace, with a 2.1% increase, down from 2.7% the previous year

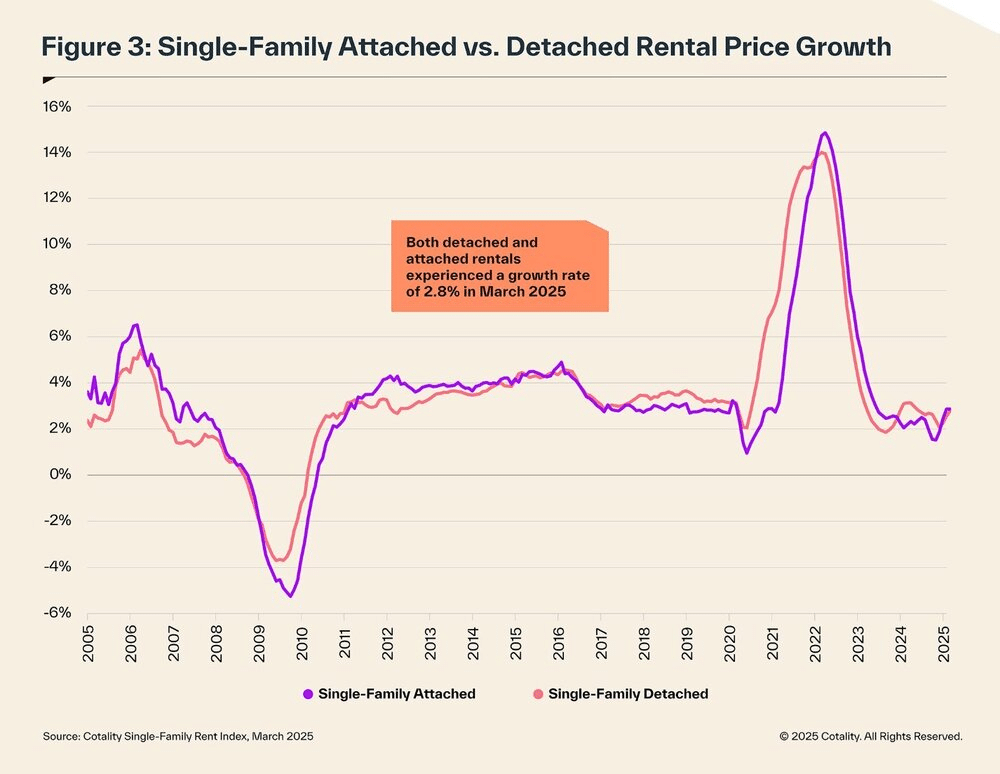

- Attached and detached rentals grew at the same rate, 2.8% year over year

📈 Los Angeles Tops Growth List Amid Post-Wildfire Demand

Among major metropolitan areas, Los Angeles recorded the highest rent growth at 6.8% annually. This surge is partially due to housing shortages following destructive wildfires in January, which reduced the availability of habitable housing stock.

Other notable performers include:

- Washington, D.C.: 6% annual rent growth

- Miami: Just 1.5% growth, placing it on the lower end of the national trend

🧭 National Outlook: Recovery with Local Nuance

The data signals a gradual firming in the U.S. rental market, although regional differences remain stark. Areas with increased rental inventory are seeing flat or falling rents, while others, particularly those recovering from natural disasters, are facing rapid rent escalations.

💡 What It Means for Investors and Property Managers

- Investors should monitor regions with growing high-end demand and limited inventory, especially those impacted by natural disasters.

- Property managers in high-supply areas like Dallas should prepare for increased tenant bargaining and adjust pricing strategies accordingly.

- Renters in high-demand regions may face steeper rent hikes, especially for premium homes.

As the rental market continues to stabilize, staying informed about local supply shifts and economic pressures will be key for both landlords and tenants.