As newly imposed tariffs dominate national headlines, many in the real estate industry are asking: how much does international trade really impact the U.S. housing market? The answer, according to the National Association of Realtors (NAR), is complex and highly dependent on a state’s economic ties to global commerce.

📦 Trade Policy: National Rule, Local Impact

While tariffs are set at the federal level, their economic ripples are felt differently across the country. States with export-heavy economies or deep supply chain links to other countries are more susceptible to trade disruptions. Others, especially those reliant on services like tourism, finance, or tech, tend to be more insulated.

For example, Texas and Arizona are heavily engaged in cross-border trade with Mexico, while West Coast states like California and Washington focus more on trade with Asia. This dynamic helps explain not just economic output, but housing demand, warehouse development, and job growth patterns.

🌍 Top Export-Heavy States

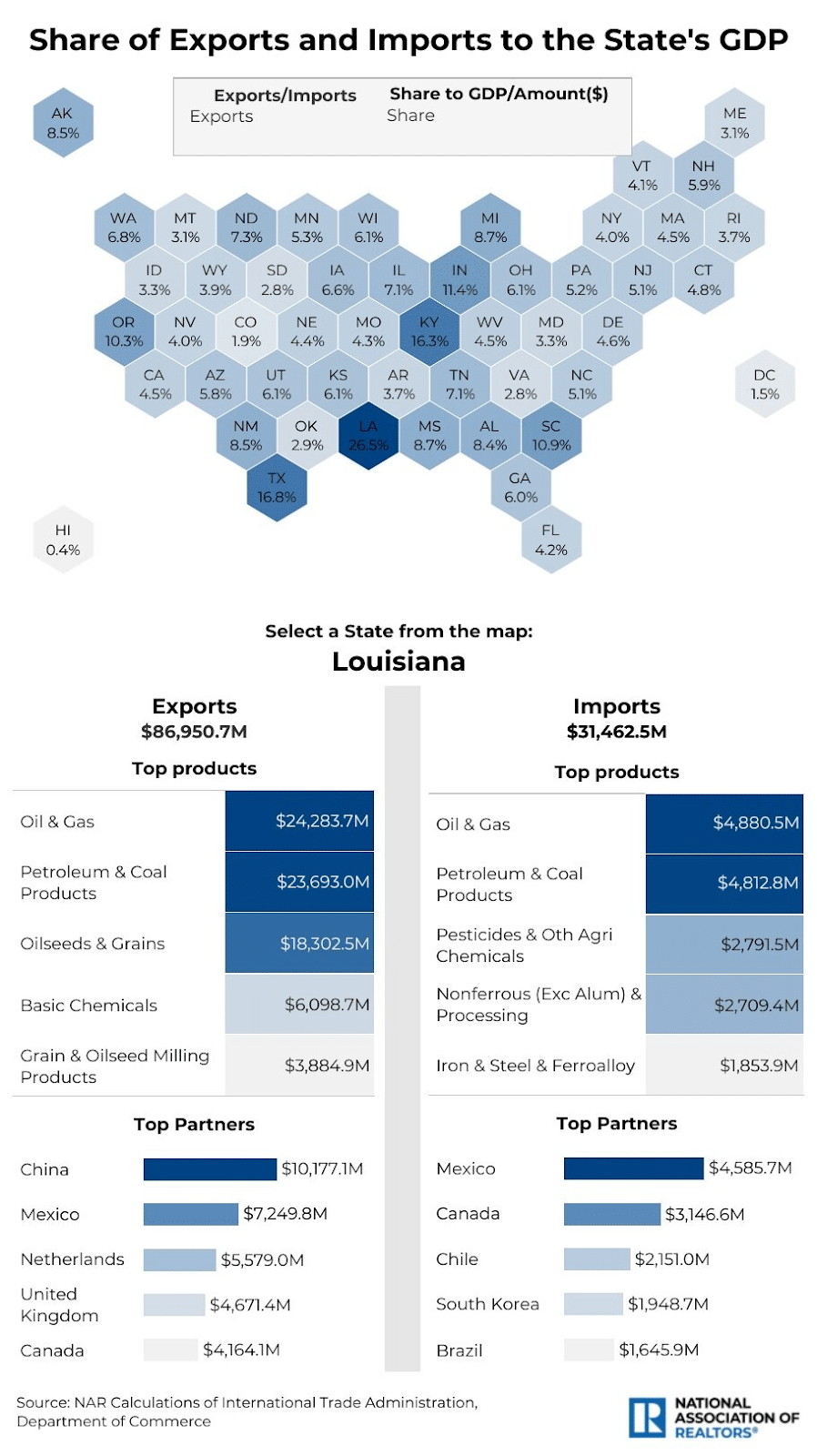

Exports represent goods made in the U.S. and sold abroad. NAR highlights the following states as most dependent on exports:

- Louisiana (26.5% of GDP): Driven by energy and chemicals, key partners include China and Mexico.

- Texas (16.8%): A major hub for oil, tech, and chemical exports, sends over $30B to Mexico, Canada, and the Netherlands.

- Kentucky (16.3%): Strong in auto and aerospace exports to Canada and Europe.

- Indiana, South Carolina, Oregon, and Michigan also play significant roles in global supply chains.

Surprisingly, California, Florida, and New York rank lower due to their service-based economies.

🚢 States Dependent on Imports

Some states depend more on foreign goods than on exports:

- Kentucky (32.3% of GDP) leads again, with heavy pharmaceutical and auto imports.

- Michigan, Indiana, Tennessee, Georgia, and Illinois serve as logistics and industrial hubs with high import ratios.

- Rural states like South Dakota, Nebraska, and Wyoming are far less dependent on imports, relying more on domestic supply.

⚖️ Balanced Trade States: High Imports & Exports

States like Kentucky, Texas, Indiana, and Michigan are deeply embedded in both import and export flows. This dual dependence makes them more sensitive to global shocks, whether in the form of tariffs, foreign manufacturing delays, or supply chain issues.

👷 Labor Market Volatility

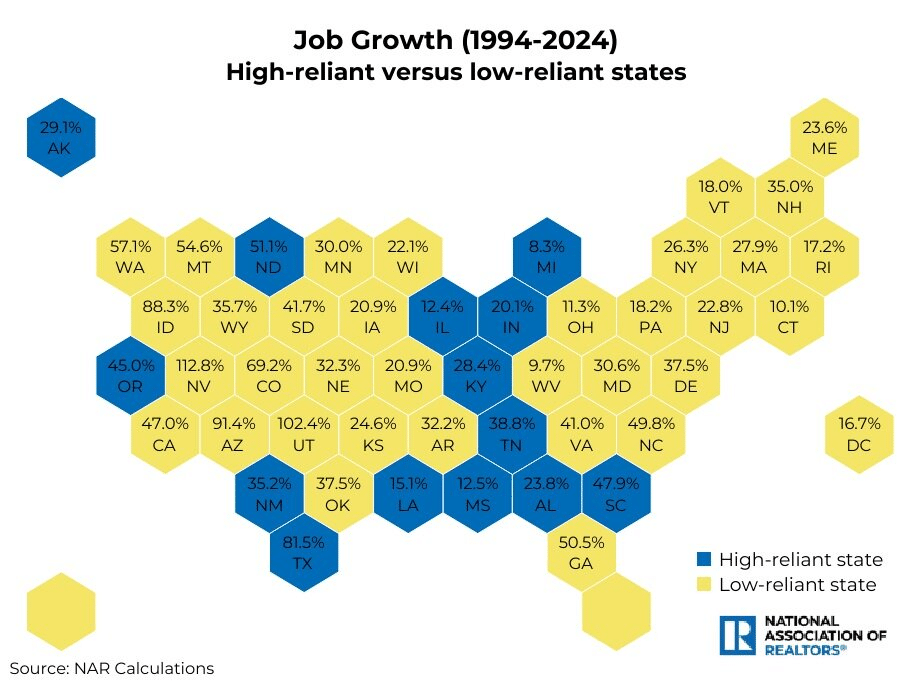

Trade-dependent states often experience greater job volatility. For instance, Texas and Michigan see employment shifts tied directly to global trends. In contrast, states with smaller trade footprints have seen stronger, more stable job growth over the past few decades.

Since NAFTA’s 1994 signing:

- Low trade-reliant states (exports <7% of GDP) grew jobs by 39% on average

- High trade-reliant states averaged 32% job growth

States like Nevada, Utah, and Arizona more than doubled their job numbers over the last 30 years, despite lower trade exposure.

🏘️ Housing Market Trends: Trade vs. Demand

Here’s where it gets interesting: housing prices have surged faster in states less tied to international trade.

- Low trade-reliant states saw an average home price increase of 291% since 1994

- High trade-reliant states saw 237% growth

Leaders in appreciation include:

- Florida (+406%)

- Washington (+379%)

- Colorado (+377%)

This suggests that lifestyle, migration, job opportunity, and housing scarcity play more dominant roles in housing demand than international trade activity.

🔍 What It Means for Real Estate

For agents, investors, and developers, these insights highlight a crucial point:

While trade shapes the economic foundation of many states, housing markets are primarily driven by where people want to live, work, and invest.

Key takeaways:

- Trade exposure affects logistics, job growth, and development

- But demographics, labor demand, and local amenities drive long-term housing trends

- Regions with lower trade reliance are seeing faster home price growth and job stability

💡 Final Thoughts

Understanding how your state fits into the global trade picture can offer valuable context, especially in uncertain times. But real estate decisions should still center around human behavior, population trends, and local market fundamentals.

Even amid tariffs and trade wars, one truth remains: people go where the opportunities and quality of life are best.