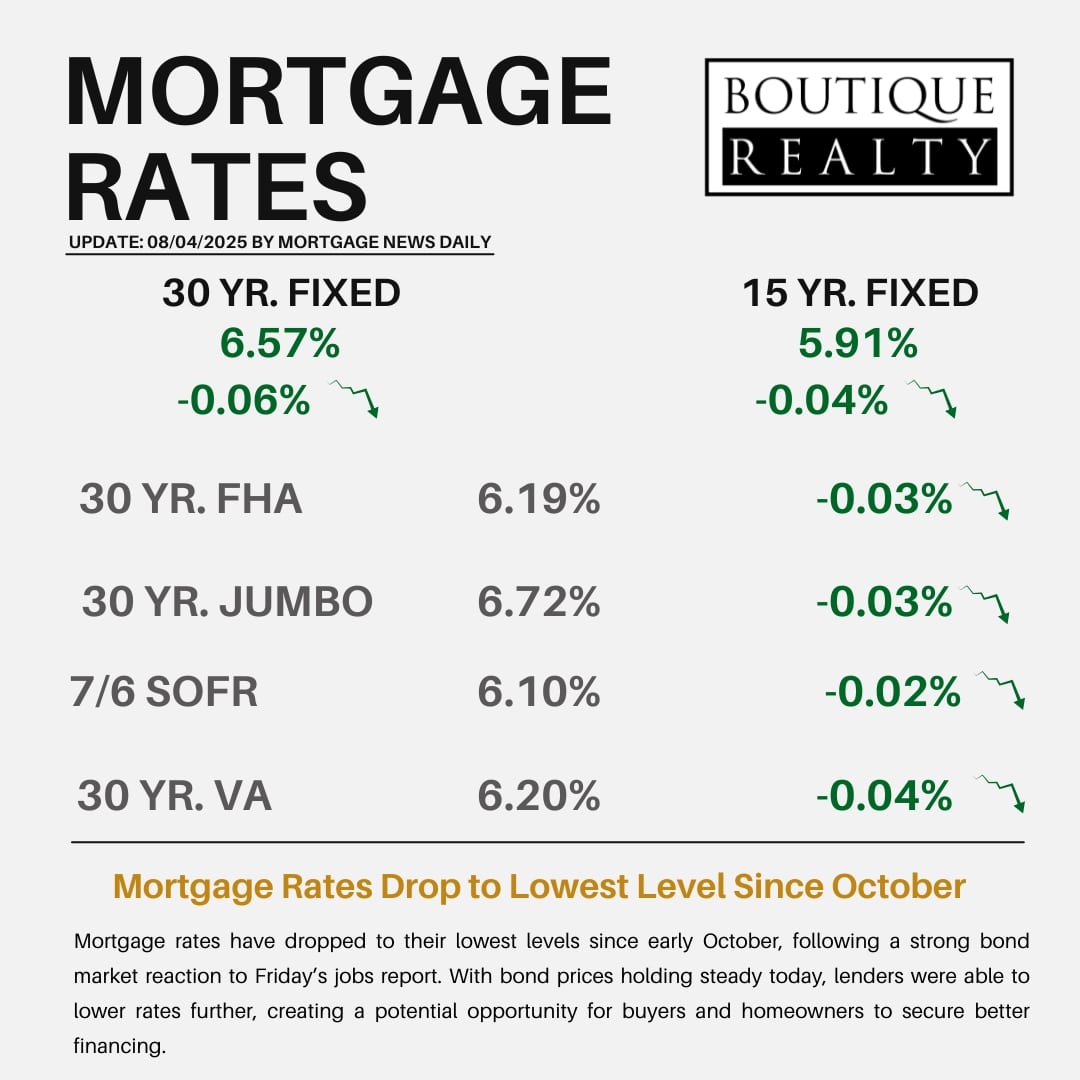

Homebuyers and homeowners considering a refinance just received welcome news: mortgage rates have dropped to their lowest levels since early October. This recent shift offers a potential opportunity for borrowers to lock in lower rates and reduce long-term costs.

Why Mortgage Rates Are Falling

Mortgage rates are primarily influenced by the bond market, which reacts to a range of economic indicators. One of the most influential of these is the monthly U.S. jobs report. Released on Friday, the latest report triggered a sharp surge in bond buying—a move that typically results in lower yields and, consequently, lower mortgage rates.

The bond market’s reaction to the jobs data was so substantial that it outpaced mortgage lenders’ ability to immediately adjust their rate sheets. This lag is not unusual during times of significant market volatility. When bonds swing quickly in one direction, lenders often proceed with caution, gradually adjusting rates to avoid overcommitting amid an uncertain short-term outlook.

Momentum Carries Into the New Week

Despite Friday’s delayed adjustment, lenders came into Monday’s session with room to reduce rates further. Fortunately for consumers, today’s bond market held steady—and even improved slightly—providing additional downward pressure on rates. This follow-through allowed lenders to confidently lower their offerings, resulting in the most favorable mortgage rates in nearly ten months.

What This Means for Consumers

For those in the market to purchase a home or refinance an existing mortgage, this development presents an excellent opportunity. Here’s why:

- Lower monthly payments: A reduced interest rate directly decreases the monthly cost of a mortgage.

- Increased affordability: Buyers may be able to qualify for more home with the same budget.

- Improved refinance potential: Homeowners locked into higher rates might now benefit from refinancing.

Caution Still Warranted

While today’s rates are encouraging, it’s important to remember that the bond market—and by extension, mortgage rates—can be unpredictable. Economic data releases, Fed policy updates, and global financial events all have the power to quickly shift market dynamics. Those interested in taking advantage of current conditions should consider speaking with a mortgage professional sooner rather than later.

In Summary:

Thanks to a sharp bond market reaction to Friday’s jobs report and stable performance today, mortgage rates have reached their lowest point since early October. This could be a pivotal moment for buyers and homeowners seeking to maximize their financial options in a still-competitive housing market.