Mortgage rates tumbled Friday, hitting their lowest level since early April — and possibly their lowest since October 2024 — after a weaker-than-expected U.S. jobs report sent bond markets rallying.

The Bureau of Labor Statistics reported that the economy added 73,000 jobs in July, well below forecasts of 110,000. Even more significant were revisions to previous months’ data, which erased 253,000 jobs from earlier estimates, suggesting the labor market is softer than previously believed.

Why the Jobs Report Moves Rates

The monthly jobs report — officially called the Employment Situation Summary — is widely regarded as the single most influential piece of economic data for mortgage rates. Strong job growth tends to push rates higher by fueling inflation concerns and keeping pressure on the Federal Reserve to hold or raise interest rates. Weaker job numbers often have the opposite effect.

“No other economic report has as much power to cause volatility in rates, for better or worse,” Graham said. “Today’s numbers clearly landed on the better side for borrowers.”

Revisions Drive the Market Reaction

While July’s headline job figure was disappointing, it was the substantial revisions to earlier reports that jolted markets.

Revisions are common — the BLS updates prior data as more employer information comes in — but the latest adjustments were unusually large, effectively erasing a quarter of a million jobs.

For investors, the takeaway was clear: the labor market isn’t as strong as initially thought. That drove bond yields sharply lower as traders bet the Fed may ease up on its policy stance — and mortgage rates, which move in step with bonds, followed.

Impact on Borrowers

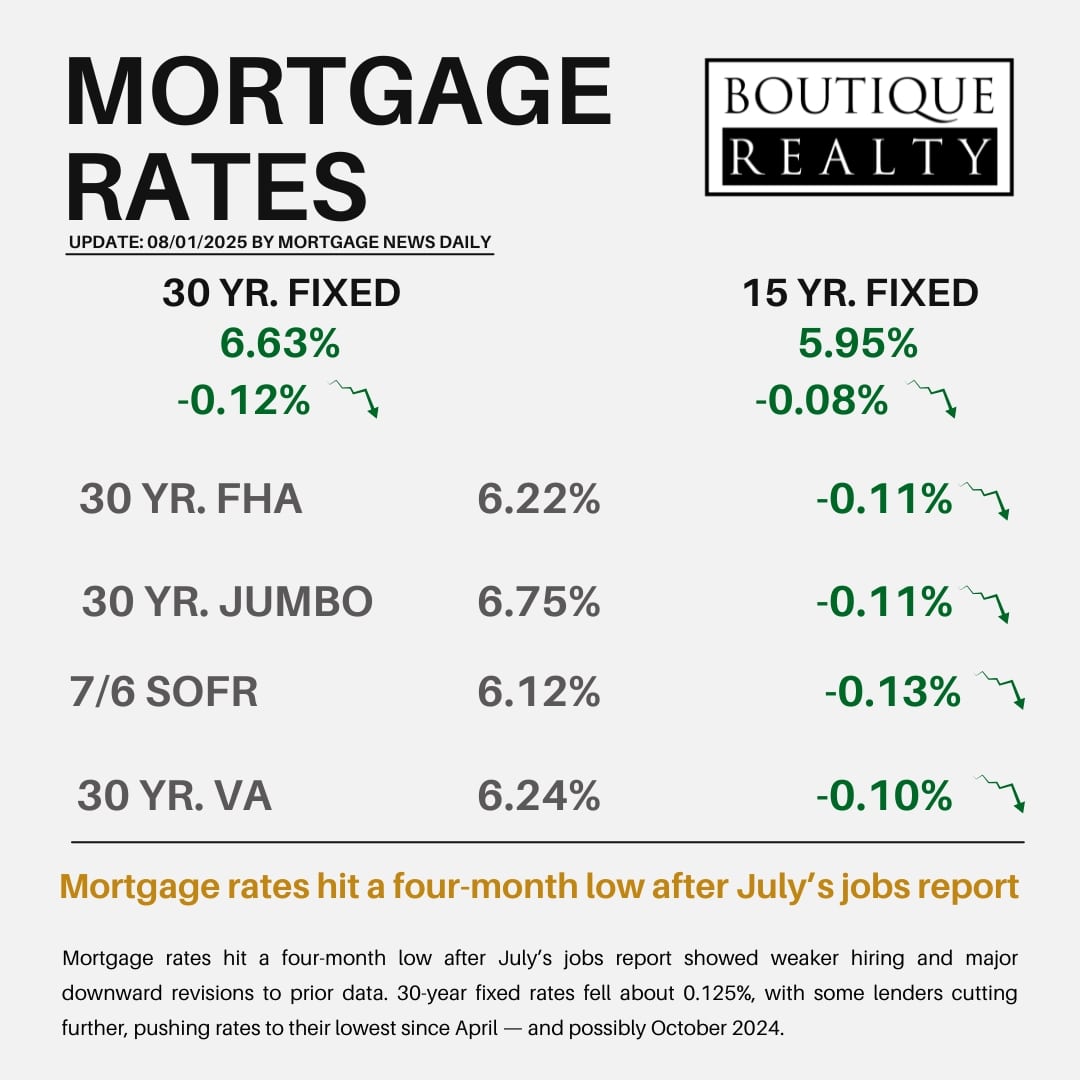

Average 30-year fixed mortgage rates fell about 0.125 percentage points on Friday’s rate sheets, and several lenders issued mid-day price improvements as the bond rally deepened.

Rates are now at their lowest since early April, and with further adjustments, they could mark the lowest levels since October 2024.

What’s Next

The drop caps weeks of volatility in mortgage rates as markets weighed inflation reports, Federal Reserve commentary, and housing market data.

If the labor market continues to soften, analysts say it could strengthen expectations for Fed rate cuts later this year — and bring additional relief for borrowers in the months ahead.

For now, buyers and homeowners looking to refinance may have just been handed the most favorable mortgage conditions in months.