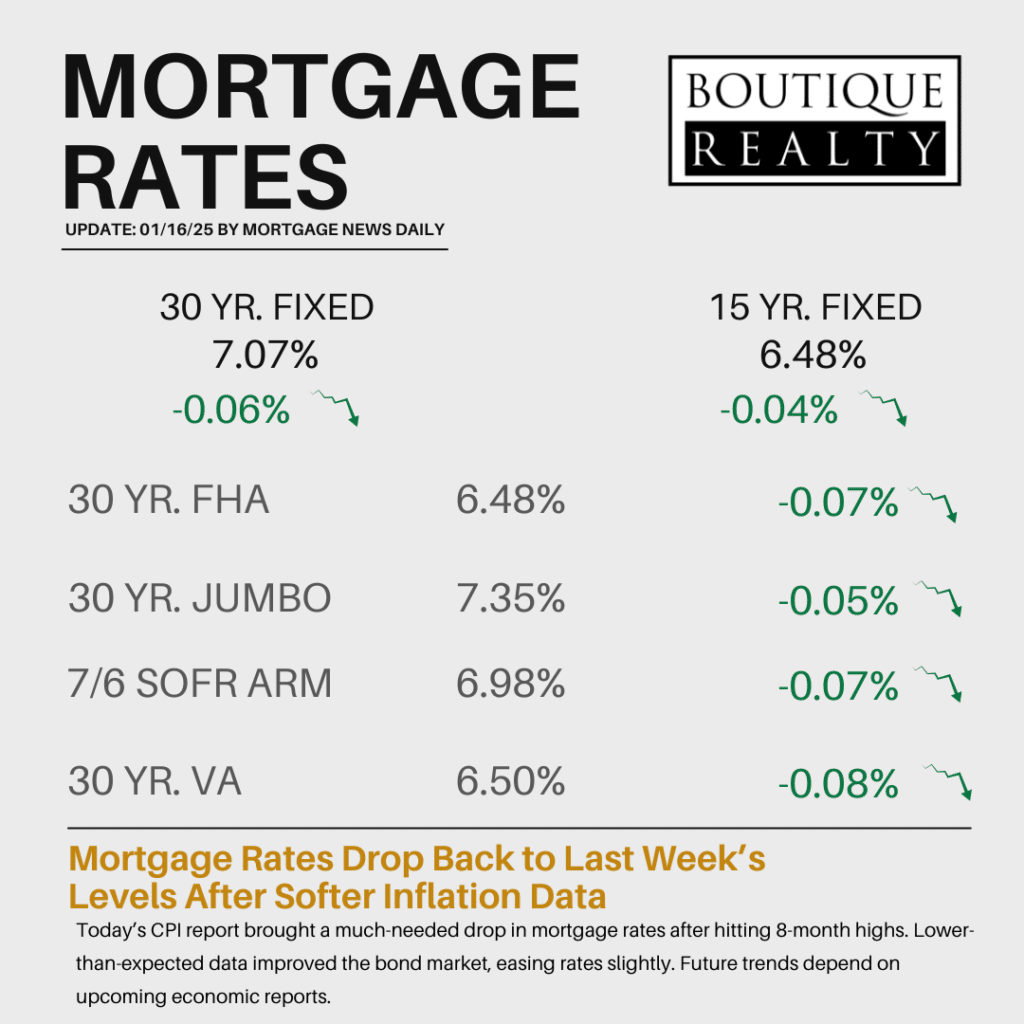

In a welcome turn of events for homebuyers and homeowners, mortgage rates have dropped back to last week’s levels after the release of the Consumer Price Index (CPI) report for January. This highly anticipated economic data provided a much-needed push for rates, bringing relief to many navigating today’s housing market.

Here’s what happened, why it’s important, and what it could mean for you.

What Caused the Drop in Mortgage Rates?

The CPI report, a key indicator of inflation, came in softer than expected. When inflation data shows a decline or slows its pace, it often signals that the Federal Reserve may ease its stance on interest rate hikes. This dynamic can lead to improvements in the bond market, which directly influences mortgage rates.

For context, mortgage rates had recently reached their highest levels in eight months. However, the softer CPI data prompted an immediate positive reaction in the bond market, allowing lenders to adjust rates downward.

Why Are Economic Reports Like the CPI So Influential?

Mortgage rates are closely tied to financial markets, which react swiftly to major economic reports like the CPI or jobs data. These reports provide insights into the overall health of the economy, including inflation and employment trends, which influence the Federal Reserve’s monetary policy decisions.

While markets always anticipate economic reports, their outcomes can be unpredictable. A report like the CPI has the potential to push rates in either direction, but in this case, it favored a drop—a scenario often seen when rates are at extended highs followed by rate-friendly news.

What Does This Mean for Homebuyers and Homeowners?

The decrease in mortgage rates, while modest, is a step in the right direction for those looking to buy, refinance, or secure more affordable monthly payments. Lower rates can improve purchasing power, making it easier for buyers to afford homes and for homeowners to refinance into better loan terms.

Even small rate reductions can significantly impact long-term savings. For instance, on a $400,000 mortgage, a 0.25% decrease in rates could save you thousands of dollars over the life of the loan.

What’s Next for Mortgage Rates?

While the recent drop in rates is a positive development, it’s too early to predict how long this trend will last. Future economic data and Federal Reserve policy decisions will play a critical role in determining whether this improvement is sustained.

Upcoming reports on jobs, retail sales, and the housing market could further influence rates. For now, the softened CPI data provides a moment of relief and an opportunity for those considering home purchases or refinancing.

Conclusion: A Hopeful Start to 2025

The drop in mortgage rates following softer inflation data is a bright spot for the housing market as we begin 2025. For buyers and homeowners, this presents a chance to lock in better rates and take steps toward their financial goals.

While the future remains uncertain, this development underscores the importance of staying informed about market trends and acting when opportunities arise. Whether you’re planning to buy your first home, refinance, or invest in real estate, now might be the time to explore your options and seize the advantages of a favorable rate environment.